Closing the gap: the rise of prescription digital therapeutics

Back in the late 1990s, in addition to watching The Matrix for the first time (yes, it’s been that long) one of the hot topics for Pharma brand teams was “the augmented brand”.

Sign up for our 'Focus on Pharma' Newsletter

We'll send you a new, insightful article every month. We won't share your details with anyone else and we won't spam you.

The goal was deceptively simple: add value to your brand with a range of services and solutions that improve outcomes, looking to close the gap between the results seen in clinical trials vs everyday clinical practice. Doing so would build a genuine competitive advantage, leading to the growth all teams wanted to see.

The reality though was somewhat more challenging, as the behaviour of patients taking regular medications in the real world is quite different from that seen in the closely monitored, protective and supportive setting of a clinical trial.

Pharma teams have been keeping an eye on successive waves of health and wellness apps and applied the thinking to address their own challenges

The first attempt to close the gap was with educational services to build awareness of both disease and treatment options. Next came support services targeting improvements in adherence. More recently we’ve seen efforts directed at delivering easy-to-use, accessible diagnostics aimed at focusing on those patients most likely to benefit from a specific therapy.

Yet whilst each of these approaches clearly improves outcomes, the benefits have often been more incremental than desired.

Enter digital technologies, where Pharma teams have been keeping an eye on successive waves of health and wellness apps and applied the thinking to address their own challenges.

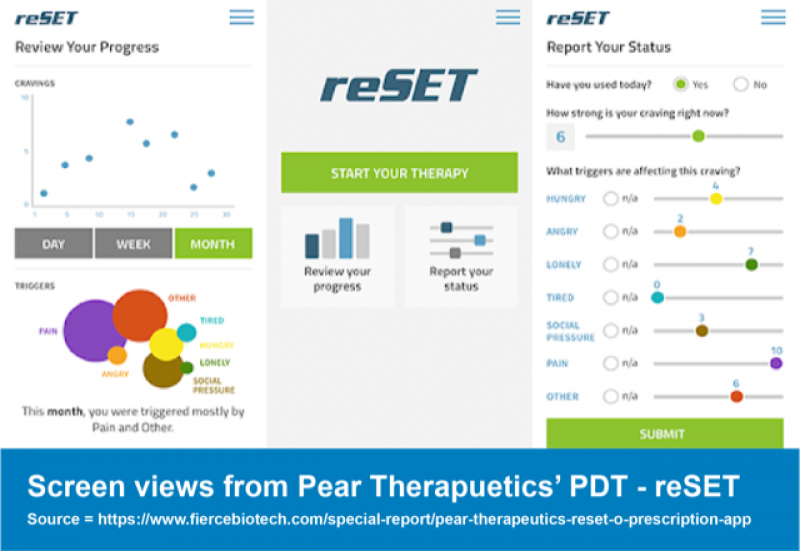

Most recently we’ve seen the rise of clinical trial and regulatory success for prescription digital therapeutics (PDTs), like Pear Therapeutics’ reSET (for substance use disorders), approved by the FDA in 2017.

Can digital health (finally) close the gap?

Digital health was growing rapidly, even before the current pandemic further increased demand. Estimates of future market value might vary substantially, from US$8 billion to US$32 billion by 2025, but growth rates are consistently forecast to remain greater than 20% p.a for a number of years (3), (4).

So it’s not surprising to see increasing levels of big Pharma interest in the value an adjunctive PDT could bring to their brand, whether through acquisition or partnering with existing PDT start-ups or building their own in-house digital capability.

it’s not surprising to see increasing levels of big Pharma interest in the value an adjunctive PDT could bring to their brand

Pear Therapeutics partnered with Sandoz, the generics subsidiary of Novartis, for both of its currently approved PDTs: reset and reSET-O. Although this partnership has since ended, Pear continues to work with Novartis for their upcoming digital therapeutics targeting multiple sclerosis and schizophrenia (5).

The early partnership allowed Pear to build the “standalone commercial infrastructure” to now begin running both reSET and reSET-O by itself whilst allowing Novartis to gain an inside look into what it took to become the makers of the first FDA approved PDT.

Click Therapeutics, a company developing PDTs for smoking cessation, insomnia, and acute coronary syndrome amongst others, has partnered with the American subsidiary of Otsuka. This deal provides Click with the investment required for the development of an additional PDT targeting major depressive disorder. The funding is set to be split with $10 million for regulatory and upfront costs, followed by $20 million for development costs and a further $272 million if the therapeutic hits commercial milestones (2). Otsuka will be hoping for improved real world evidence when the use of its brands are supported by an effective PDT, providing a competitive advantage in the increasingly competitive market for anti-depressants.

Akili Interactive, the company with the first prescription treatment delivered through gaming, has recently announced a partnership with Shionogi. Shionogi gained exclusive rights to the clinical development, sales and marketing of Akili’s PDTs for attention deficit hyperactive disorder and autism spectrum disorder in Japan and Taiwan.

It’s critically important that the fit with the brand (or portfolio) vision and brand positioning statement is right.

Shionogi has been clear in their intent to offer an enhanced portfolio of treatment options to patients; the new digital treatment options from Akili will sit alongside their selective alpha2A-adrenergic receptor agonist, Intuniv (guanfacine) and their recently-launched dextroamphetamine pro-drug, Vyvanse (lisdexamfetamine). Physicians will be able to mix and match, tailoring their approach to each individual patient with such distinctive needs.

In return the Pharma company will pay Akili $20 million upfront with $105 million in potential milestone payments to follow (2), (6), (7).

So – lots of potential for PDTs used in combination with pharmacological brands in finally closing the gap between the results of clinical trials and the realities of clinical practice. But partnerships are certainly not seen as the easy option.

In a recent survey of digital therapeutic industry leaders, in answer to the question "On a scale of one to ten - with ten being "very difficult" - how challenging is it to drive a successful partnership between a digital-therapeutics start-up and a pharmaceutical company?" the most common response was 8/10. (8)

Regulatory support accelerating with the pandemic

Undoubtedly driving increased interest in PDTs are the demands of healthcare systems having to respond very quickly to the impact of the COVID-19 pandemic.

Many have written of the transition to digital working and delivery in healthcare, allowing people continued access to medical treatment whilst minimising face to face contact. Regulatory authorities, too, have been quick to acknowledge the need to offer new options to both HCPs and patients in new ways.

For example, the FDA allowed Pear Therapeutics to launch its product candidate Pear-004 to schizophrenia patients through a select set of HCPs and academic centres before gaining market approval. This decision was made purely because the current COVID-19 pandemic has disrupted HCPs’ ability to provide the usual mental health care for schizophrenia patients, presenting a substantial risk to outcomes (9). The PDT can, it is hoped, go some way to plug the gap.

Many have written of the transition to digital working and delivery in healthcare, allowing people continued access to medical treatment whilst minimising face to face contact.

Pear Therapeutics is not the only company benefitting from this new appreciation of the potential value of PDTs. Eight other companies have now been selected by the FDA to be a part of their Digital Health Software Pre-certification Program (10). This programme is designed to inform the development of a tailored regulatory model for future use with PDTs and clearly demonstrates the FDA’s commitment to getting therapies approved and into the hands of patients.

The pandemic has been identified by leaders in the digital therapeutics space as a significant opportunity for the rise of their industry; an opportunity to demonstrate their worth and work collaboratively with others in the healthcare industry as equal partners. In a recent virtual panel on digital therapeutics they spoke about how “the stigma around being able to treat people digitally has almost been completely removed” (11). To us it seems that regulatory authorities agree.

With both Pharma and regulatory support, what does the future look like for PDTs?

With more and more people across the globe having access to the internet via devices that they keep with them 24/7 scalability is within reach. We believe that PDTs have the potential to make a substantial difference to outcomes, particularly if they can work synergistically with other medical interventions to improve outcomes.

Just like all other consumers, HCPs, particularly digital native HCPs, are increasingly comfortable with using digital apps attached to products they encounter in their everyday lives to ease use and improve performance. Inevitably they will become more comfortable with the idea of the same approach to support the treatment they are prescribing for their patients.

The big data owners like Apple, Google and Amazon are working to leverage their access to vast reservoirs of data - and loyal customers - to enter the digital therapeutic space. So expect to see closer collaboration with Pharma and an ever-increasing pipeline of PDTs.

These initiatives will surely drive earlier diagnosis, and it seems highly likely that innovators will start to look beyond diagnosis to applications for treatment.

As we continue to work together with Pharma teams to help build truly sustainable competitive advantages for their brands and portfolios, we expect PDTs to become a far more common part of the solution; a genuine opportunity to close the gap.

If you’d like to consider the opportunities to close the gap between clinical trial and real world outcomes for your brand, please do get in touch.

We’d love to hear from you.

References

1. Digital health, digital therapeutics, digital medicines - what’s in a name? - MedCity News. Available at: https://medcitynews.com/2020/01/digital-health-digital-therapeutics-digital-medicines-whats-in-a-name/?rf=1.

2. Prescription Digital Therapeutics (PDTx): an Investor’s Guide | by OMERS Ventures | OMERS Ventures | Medium. Available at: https://medium.com/omers-ventures/prescription-digital-therapeutics-pdtx-an-investors-guide-2f5ddc258896.

3. Pharma Voice. DIGITAL THERAPEUTICS EXPLORING DIGITAL SOLUTIONS IN THE MODERN AGE OF HEALTHCARE SEPTEMBER 2020. Available at: https://www.pharmavoice.com/wp-content/uploads/PharmaVOICE-TherapeuticDigest-Digital-Therapeutics.pdf?tracker_id=1602500289

4. Digital Therapeutics Market to Exceed $32 billion by 2024. Available at: https://www.juniperresearch.com/press/press-releases/digital-therapeutics-market-exceed-32-billion-2024.

5. Sandoz says ‘no’ to Pear Therapeutics’ digital apps, handing back rights -. Available at: https://pharmaphorum.com/news/sandoz-says-no-to-pear-therapeutics-digital-app-handing-back-rights/.

6. Akili Announces FDA Clearance of EndeavorRxTM for Children with ADHD, the First Prescription Treatment Delivered Through a Video Game — Akili Interactive. Available at: https://www.akiliinteractive.com/news-collection/akili-announces-endeavortm-attention-treatment-is-now-available-for-children-with-attention-deficit-hyperactivity-disorder-adhd-al3pw.

7. Akili and Shionogi pair up to bring digital therapies to Japan and Taiwan in $125M deal | FierceBiotech. Available at: https://www.fiercebiotech.com/medtech/akili-and-shionogi-pair-up-to-bring-digital-therapies-to-japan-and-taiwan-125m-deal.

8. Survey conducted at the Promise of Digital Therapeutics conference with 23 respondents in 2020.

9. Pear Therapeutics to Release Pear-004 to Help People Living with Schizophrenia During the COVID-19 Crisis - Pear Therapeutics. Available at: https://peartherapeutics.com/pear-therapeutics-to-release-pear-004-to-help-people-living-with-schizophrenia-during-the-covid-19-crisis/.

10. Digital Health Software Precertification (Pre-Cert) Program | FDA. Available at: https://www.fda.gov/medical-devices/digital-health-center-excellence/digital-health-software-precertification-pre-cert-program#who.

11. Why digital therapeutics are flourishing under COVID-19 | MobiHealthNews. Available at: https://www.mobihealthnews.com/news/why-digital-therapeutics-are-flourishing-under-covid-19.

12. Amazon pushes further into healthcare with NHS Alexa deal | The Drum. Available at: https://www.thedrum.com/news/2019/07/10/amazon-pushes-further-healthcare-with-nhs-alexa-deal.

13. Health – Google Research. Available at: https://research.google/teams/health/.

14. Healthcare - Apple Watch - Apple (UK). Available at: https://www.apple.com/uk/healthcare/apple-watch/.

Share this

You May Also Like

These Related Stories

Are diagnostics the solution to growing healthcare needs?

Clinical Thought Leaders have feelings too

.png?width=657&height=57&name=OXFORD%20LOGO%20(1).png)

No Comments Yet

Let us know what you think